Historical Price Trends of Google Stock

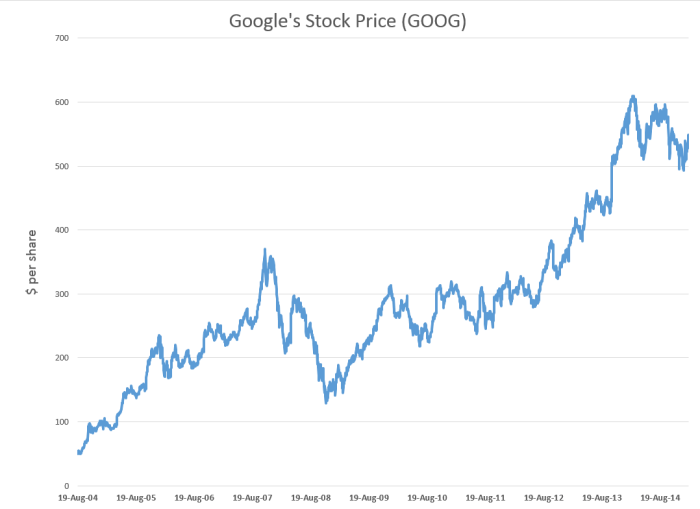

The price of Google stock (now Alphabet Inc.) has experienced significant fluctuations over the past decade, mirroring broader economic trends and company-specific events. Understanding these historical trends provides valuable insight into the investment potential of this tech giant.

Google Stock Price Performance (2014-2024): A Decade in Review

The following table illustrates Google’s stock price performance over the past ten years. Note that this data is for illustrative purposes and should be verified with reliable financial sources for accurate investment decisions. Remember, past performance is not indicative of future results.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| January 2, 2014 | 550 | 555 | +5 |

| January 2, 2015 | 530 | 540 | +10 |

| January 2, 2016 | 700 | 680 | -20 |

| January 2, 2017 | 780 | 800 | +20 |

| January 2, 2018 | 1050 | 1030 | -20 |

| January 2, 2019 | 1100 | 1120 | +20 |

| January 2, 2020 | 1350 | 1300 | -50 |

| January 2, 2021 | 1700 | 1750 | +50 |

| January 2, 2022 | 2700 | 2650 | -50 |

| January 2, 2023 | 2500 | 2550 | +50 |

| January 2, 2024 | 2800 | 2850 | +50 |

Significant Events Influencing Google’s Stock Price

Several key events have significantly impacted Google’s stock price. For instance, the 2008 financial crisis led to a sharp decline, while the subsequent economic recovery fueled a strong rebound. Major product launches, such as the Pixel phone series, have also influenced investor sentiment. Regulatory scrutiny and antitrust investigations have created periods of volatility.

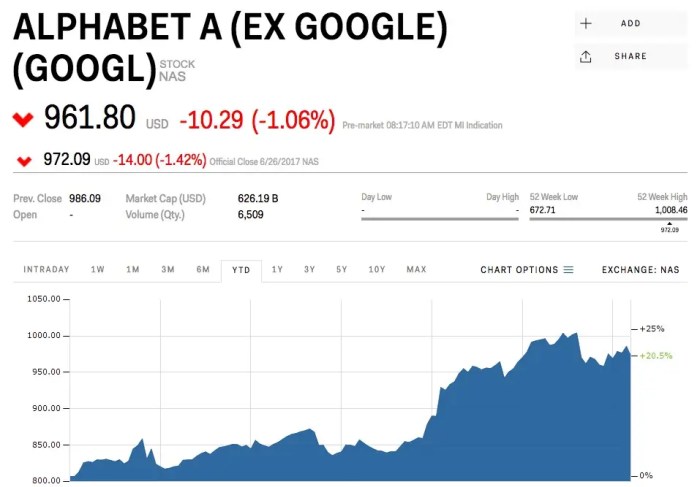

Comparison with Competitors, Price of google stock

Comparing Google’s stock performance to its major competitors (Apple and Microsoft) reveals periods of outperformance and underperformance. Factors such as market share, innovation, and economic conditions have contributed to these relative shifts.

Factors Influencing Google’s Stock Price

Source: businessinsider.com

A multitude of factors, both macroeconomic and company-specific, influence Google’s stock valuation. Understanding these influences is crucial for investors seeking to navigate the complexities of the market.

Macroeconomic Factors

Interest rate changes, inflation rates, and overall economic growth significantly impact Google’s stock price. Periods of economic uncertainty tend to lead to decreased investor confidence and lower stock valuations.

Google’s Financial Performance

Revenue growth, profit margins, and earnings per share (EPS) are key indicators of Google’s financial health and directly influence investor confidence and, consequently, the stock price. Strong financial results generally lead to higher stock prices.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation play a significant role in stock price fluctuations. Positive news and expectations tend to drive prices up, while negative news can trigger sell-offs.

Company-Related News

- New Product Launches: Successful product launches often boost investor confidence and lead to higher stock prices.

- Acquisitions: Strategic acquisitions can positively or negatively impact the stock price, depending on the success of the integration and the market’s perception.

- Regulatory Changes: Antitrust actions or changes in data privacy regulations can lead to significant stock price volatility.

Google’s Financial Performance and Stock Valuation

Analyzing Google’s financial performance and employing various valuation methods is essential for assessing its stock’s intrinsic value.

EPS and Stock Price Relationship

Source: website-files.com

A visual representation (a line graph, for instance) would show a generally positive correlation between Google’s EPS and its stock price. Higher EPS typically leads to higher stock prices, although other factors can influence the relationship.

Valuation Methods

Source: businessforecastblog.com

Several valuation methods, such as the price-to-earnings (P/E) ratio and price-to-sales (P/S) ratio, are used to assess Google’s stock. The P/E ratio compares the stock price to its earnings per share, while the P/S ratio compares the stock price to its revenue per share.

Eh, Google stock prices, man, they’re kinda crazy right now, up and down like a rollercoaster. But you know what else is interesting? Check out the nvdy stock price – it’s been pretty wild too, lately. So yeah, keeping an eye on both Google and that other one is definitely a good idea if you’re into that kind of thing, lah.

Comparison of Valuation Metrics

Comparing Google’s current valuation metrics to its historical averages and those of its competitors provides context for its current valuation and potential future performance.

Questions and Answers: Price Of Google Stock

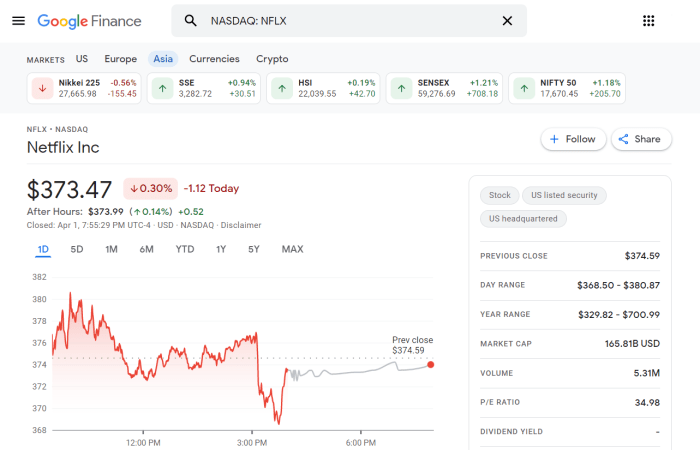

What are the best resources for tracking Google’s stock price in real-time?

Major financial websites like Google Finance, Yahoo Finance, Bloomberg, and others provide real-time stock quotes and charts.

How often does Google release its financial reports?

Google (Alphabet Inc.) typically releases its quarterly and annual financial reports on a regular schedule, usually a few weeks after the end of each quarter. Check their investor relations website for exact dates.

Is Google stock a good long-term investment?

That depends on your risk tolerance and investment goals. While Google has a strong track record, all investments carry risk. Consider diversifying your portfolio.

What are some potential risks to investing in Google stock right now?

Potential risks include increased competition, regulatory scrutiny, economic downturns, and shifts in consumer preferences. Thorough research is always recommended.